Exactly How to Lessen Danger While Taking Full Advantage Of Returns with Offshore Investment

Exactly How to Lessen Danger While Taking Full Advantage Of Returns with Offshore Investment

Blog Article

How Offshore Financial Investment Works: A Step-by-Step Malfunction for Capitalists

Offshore investment provides a structured pathway for capitalists looking for to maximize their financial approaches while leveraging worldwide possibilities - Offshore Investment. The procedure begins with the mindful choice of a jurisdiction that lines up with a financier's goals, adhered to by the establishment of an account with a reliable offshore organization. This methodical strategy not only enables for profile diversity however likewise demands continuous management to browse the complexities of worldwide markets. As we discover each action in detail, it ends up being evident that recognizing the subtleties of this financial investment technique is crucial for achieving optimal outcomes.

Understanding Offshore Investment

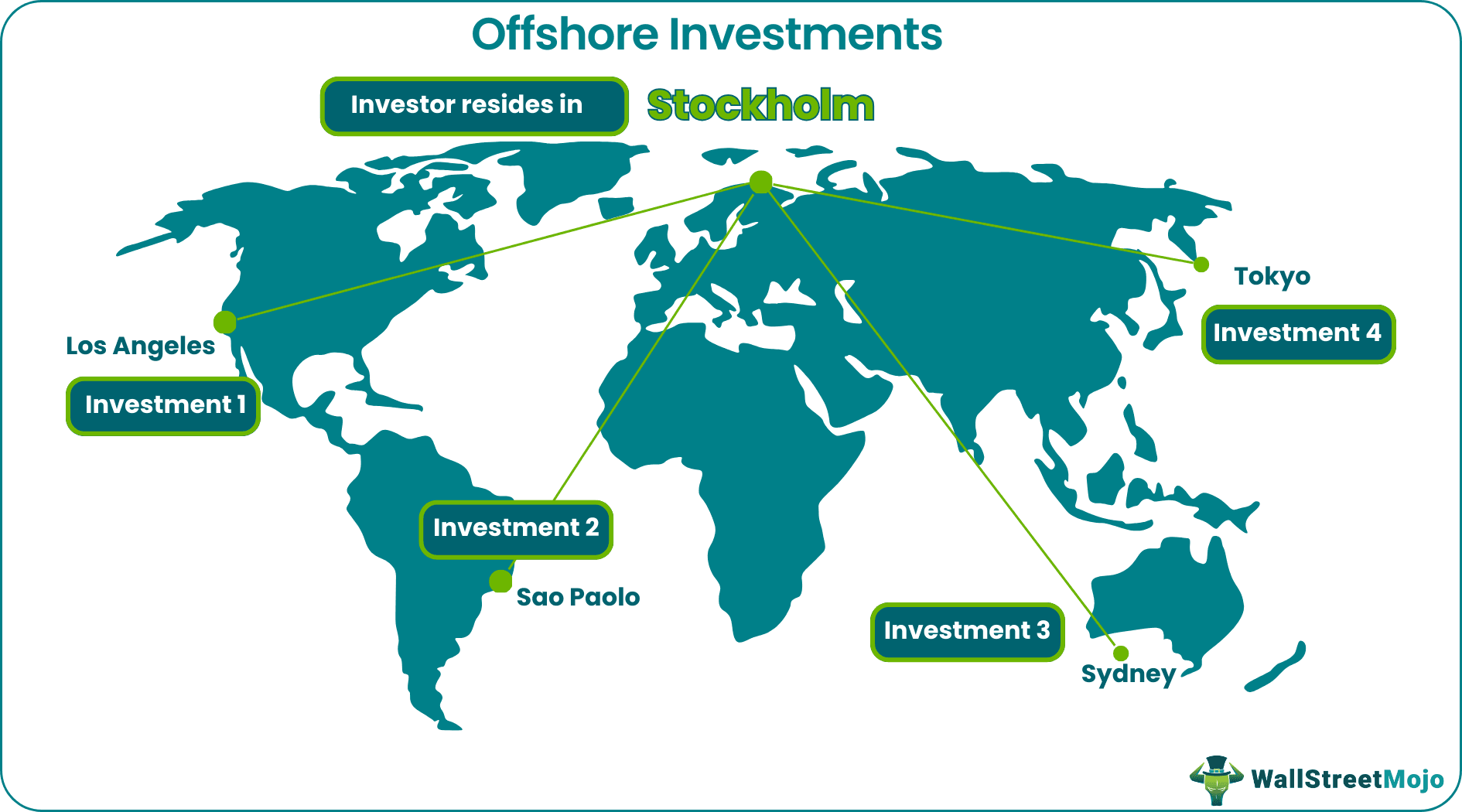

Comprehending overseas investment entails recognizing the strategic advantages it offers to companies and individuals looking for to optimize their economic portfolios. Offshore investments typically describe properties kept in a foreign territory, usually defined by desirable tax regimes, governing atmospheres, and privacy protections. The main intent behind such financial investments is to improve capital diversity, growth, and danger monitoring.

Investors can access a vast array of financial instruments through overseas venues, including stocks, bonds, shared funds, and real estate. These investments are frequently structured to abide by local laws while providing versatility in terms of possession allocation. In addition, overseas investment strategies can enable people and companies to hedge versus residential market volatility and geopolitical dangers.

An additional trick facet of overseas investment is the potential for enhanced personal privacy. A thorough understanding of both the obligations and benefits associated with overseas investments is vital for notified decision-making.

Advantages of Offshore Investing

Financiers usually turn to offshore spending for its countless benefits, including tax effectiveness, property security, and portfolio diversification. One of the key benefits is the capacity for tax optimization. Several offshore jurisdictions supply desirable tax obligation regimes, permitting capitalists to lawfully minimize their tax liabilities and maximize returns on their investments.

Furthermore, offshore accounts can give a layer of property defense. Offshore Investment. By positioning possessions in politically steady jurisdictions with solid privacy legislations, capitalists can guard their wealth from prospective legal insurance claims, creditors, or financial instability in their home countries. This form of protection is specifically attracting high-net-worth people and business owners encountering lawsuits threats

In addition, offshore investing facilitates portfolio diversification. Accessing worldwide markets permits financiers to explore possibilities in various possession courses, including property, stocks, and bonds, which might not be readily available locally. This diversification can reduce general portfolio danger and improve potential returns.

Inevitably, the benefits of overseas investing are engaging for those looking for to optimize their monetary methods. It is important for financiers to extensively recognize the implications and regulations associated with offshore financial investments to make certain conformity and attain their monetary objectives.

Choosing the Right Jurisdiction

Choosing the suitable jurisdiction for overseas investing is a critical decision that can considerably impact an investor's financial approach. The ideal jurisdiction can provide various benefits, consisting of favorable tax obligation frameworks, property security legislations, and regulative atmospheres that align with an investor's goals.

When picking a jurisdiction, think about elements such as the political stability and financial health and wellness of the nation, as these elements can influence financial investment protection and returns. The legal structure surrounding foreign investments must be reviewed to make certain compliance and he said defense of assets. Countries recognized for durable legal systems and transparency, like Singapore or Switzerland, commonly instill higher self-confidence amongst investors.

Additionally, analyze the tax obligation implications of the jurisdiction. Some nations provide eye-catching tax motivations, while others may impose rigid reporting needs. Understanding these nuances can aid in maximizing tax obligation obligations.

Steps to Establish Up an Offshore Account

Establishing an offshore account entails a collection of methodical actions that make certain compliance and safety and security. The first step is picking a reputable offshore monetary organization, which must be licensed and regulated in its territory. Conduct comprehensive research to assess the institution's trustworthiness, solutions supplied, and customer reviews.

Next, gather the required paperwork, which commonly includes recognition, evidence of address, and info concerning the source of funds. Various territories may have varying needs, so it is crucial to confirm what is required.

When the documentation is prepared, start the application process. This might include submitting forms on-line or in person, relying on the establishment's methods. Be planned for a due persistance procedure where the bank will confirm your identification and examine any type of potential threats associated with your account.

After approval, you will certainly receive your account details, enabling you to fund your offshore account. It is recommended to preserve clear documents of all deals and adhere to tax obligation policies in your house nation. Developing the account correctly establishes the foundation for effective overseas investment management in the future.

Taking Care Of and Monitoring Your Investments

As soon as an offshore account is successfully established, the focus moves to handling and checking your investments successfully. This critical phase involves a systematic strategy to ensure your assets align with your monetary objectives and take the chance of tolerance.

Begin by developing a clear investment method that details your goals, whether they are outstanding conservation, income generation, or growth. Routinely evaluate your profile's performance against these criteria to examine whether changes are needed. Using economic administration devices and platforms can facilitate real-time tracking of your investments, offering understandings right Recommended Site into market patterns and asset allotment.

Engaging with your overseas economic advisor is important. They can supply expertise and assistance, assisting you browse complicated regulative atmospheres and worldwide markets. Schedule regular reviews to go over performance, examine market problems, and recalibrate your method as required.

Additionally, stay educated regarding geopolitical developments and economic signs that may influence your financial investments. This aggressive approach enables you to react quickly to transforming situations, guaranteeing your overseas profile continues to be robust and aligned with your financial investment goals. Eventually, thorough administration and ongoing monitoring are essential for making the most of the benefits of your offshore investment technique.

Final Thought

To conclude, offshore investment supplies a critical method for portfolio diversity and danger administration. By involving and selecting a proper jurisdiction with trusted financial establishments, financiers can navigate the intricacies of global markets efficiently. The organized technique described guarantees that capitalists are well-appointed to optimize returns while adhering to lawful structures. Continued surveillance and partnership with financial consultants continue to be vital for preserving a nimble financial investment approach in an ever-evolving global landscape.

Offshore investment provides an organized path for capitalists seeking to maximize their economic techniques while leveraging global chances.Recognizing offshore financial investment involves identifying the calculated benefits it supplies to people and companies looking for to optimize their financial profiles. Offshore investments normally refer to possessions held in an international jurisdiction, frequently characterized by desirable tax regimes, regulative settings, and privacy defenses. Furthermore, overseas investment methods can make it possible for services and people to hedge against residential market volatility and geopolitical dangers.

Report this page